Objective

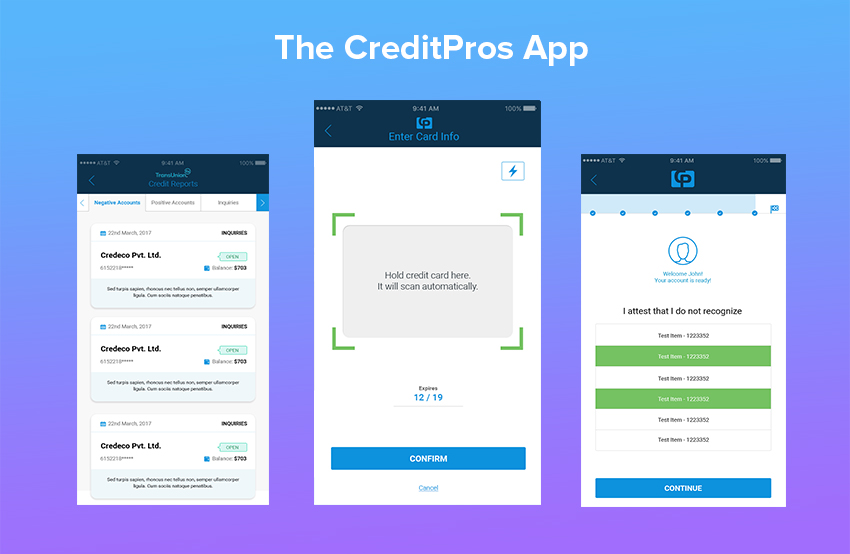

The objective of The Credit Pro (TCP) app is to create awareness among the clients so to help them understand their credit score/report well. Furthermore, with the presence of CRM capabilities, the whole process is streamlined in nature. Due to such nature, customers get benefitted in getting all the credit-related services, which include, credit score, credit report, credit analysis, and credit repair progress at a single platform. In addition to this, the clients will get an instant approval for loans and other credit applications easily and swiftly all thanks to this app.

Solution

We provide a single online platform to our customers where they can get significant credit-related information efficiently. Moreover, proper management of the credit scores, budgets, and searching an appropriate solution for credit-related frauds faced by the clients is possible due to custom CRM application. Also, we utilize the SaaS model and allow other like-minded company to use it to provide their customers with immense satisfaction.

About Company

The Credit Pros (TCP) is the aspiring American financial technology firm which is entrusted with finding a solution to the credit-related issues and meeting the expectations of their customers. As per the reports of Inc. Magazine, it is one of the 50 best places to work in the USA. It is BBB Accredited with an efficient "A+" rating.

It provides experts to the customers to save them from getting indulge in the credit-related frauds. Free consultations are offered in multiple languages so to create awareness among the clients about the credit system. It also educates about various steps taken to enhance their credit score.

Key features

- Access 24/7 Hours

- Free Tools and Tips to understand Credit Score

- Easy to Read Credit Report

- Valuable Services at No Additional Cost

- Personalized Score Insight

- ID Theft Restoration and Insurance

- Action Plan from Certified FICO Professional

- Provision of Credit Education Tool

Tools & Technologies

- Android

- iOS

3rd Party APIs

- Transunion

- Sales force

- AWS

- Sendgrid

- Amazon s3

- Power wallet

- Desk.com

XML operates in this Android-based app because of its simplicity in transport and data sharing and availability, and due to which the developers can create a new mobile app for the customers. Besides, the iOS-based app is used to create UI based interface as it works on auto-layout and also successfully alter the device orientation and screen size appropriately.

We have developed a user-friendly mobile app from scratch. ITExpertsIndya has been successfully providing all the solutions for credit-related information on a single platform to satisfy the customers' aspiration.

Transunion Interview

After payment and login, the client faces an interview in traveling through four essential phases:

-

Clients digitally signing the contract

-

Personal Information Update

-

Transunion Authentication by Social Security Number (SSN)

Rest API is a web service which is utilized to generate questionnaire, and also evaluate the reliability of the information provided by the clients. After successful authentication, the report is fetched by the system.

-

Circulating items by fetching credit items, inquiry, and public reports

Client Dashboard

When the interview section is completed, the dashboard receives all the details about the credit. After that, credit-related information (score, analysis, repair progress) and derogatory account mix are displayed to the client so that they could take essential measures to improve their credit score.

Dispute Items

Al the relevant information about the items (positive, negative, deleted, and repaired) is stored here. The client consults the occurrence of low credit score through contacting bureaus, and it might occur due to adding wrong personal information such as SSN, address, wrong name, and DOB.

Dispute Letter

The given section displays the negative items as disputes, and fax is sent to the credit bureaus in the form of letters. There is setting up of an inquiry where verification of the negative items is done and is marked closed. It indicates that the client's report us successfully repaired. Afterward, clients get access to the improved credit report on their mobile app.

Action Plan/Review

To improve credit score, there is conduction of an audit. A frame is present here where the calculation of negative and deleted items is done to generate audit. Moreover, negative and delete items are present in the Transunion report with a review procedure. It helps in removing these items and enhances their credit score.

Documents

Two critical lists are present here, namely; document and agreement list. Client's personal identity is present in the document list, which is uploaded from backend and frontend. The management of the agreement done during frontends' interview section happens in agreement lists. The users could be assigned with new agreements, or they could anytime delete the old contracts.

Credit Alerts

Do you require a regular update to get credit-based information? There is a Push section notification which sends credit alert and creates awareness among the clients about frequent changes occurring in their credit report.

Achievements

The clients now receive all the details about the credit report directly on their phone, which is no mean feat. Furthermore, they could also check issues in their credit score and can directly contact credit bureaus to improve their credit score.